an invoice number which is unique and follows on from the number of the previous invoice (if you cancel a serially numbered invoice, you must keep it to show to a VAT officer in the event of a VAT inspection).These rules state that an invoice must include:

Whether you’re a sole trader or your business is a limited company, if you're registered for VAT, you must include your VAT number on your invoices and comply with HMRC's rules about VAT invoices. If you put the name of one director or member on your invoice, you must include the names of all the directors or members. If your business is a limited company or LLP, your invoices must also show the full company name as it appears on the certificate of incorporation and its Companies House registration number and address.

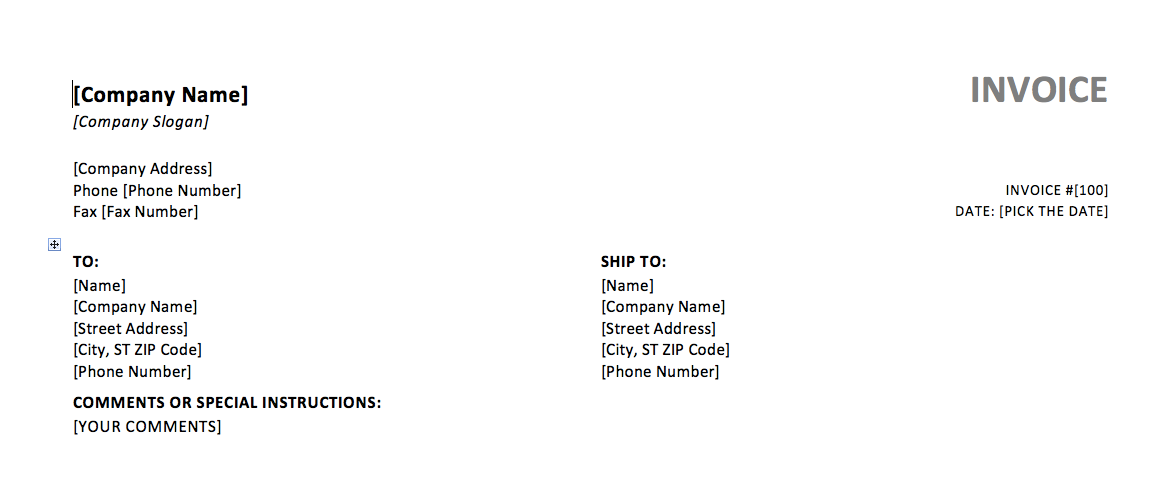

your business name, address and contact information.

You must clearly display the word ‘invoice’ on the document. There is some information that you must legally include on your invoices. If you use FreeAgent to create and send your invoices, you can use our customisation designer to create a custom invoice template that aligns with your branding. For example, if the brand tone you want to convey is fun and quirky, avoid using lawyers’ English in your invoices. Your invoice is a document that you send out from your business, so make sure that it reflects your brand - think logo, colours, fonts, and wording of the item descriptions and of your payment terms. Here's a handy checklist to keep in mind when setting up your invoice template. Invoicing basics: 5 essentials to include in your invoice template

0 kommentar(er)

0 kommentar(er)